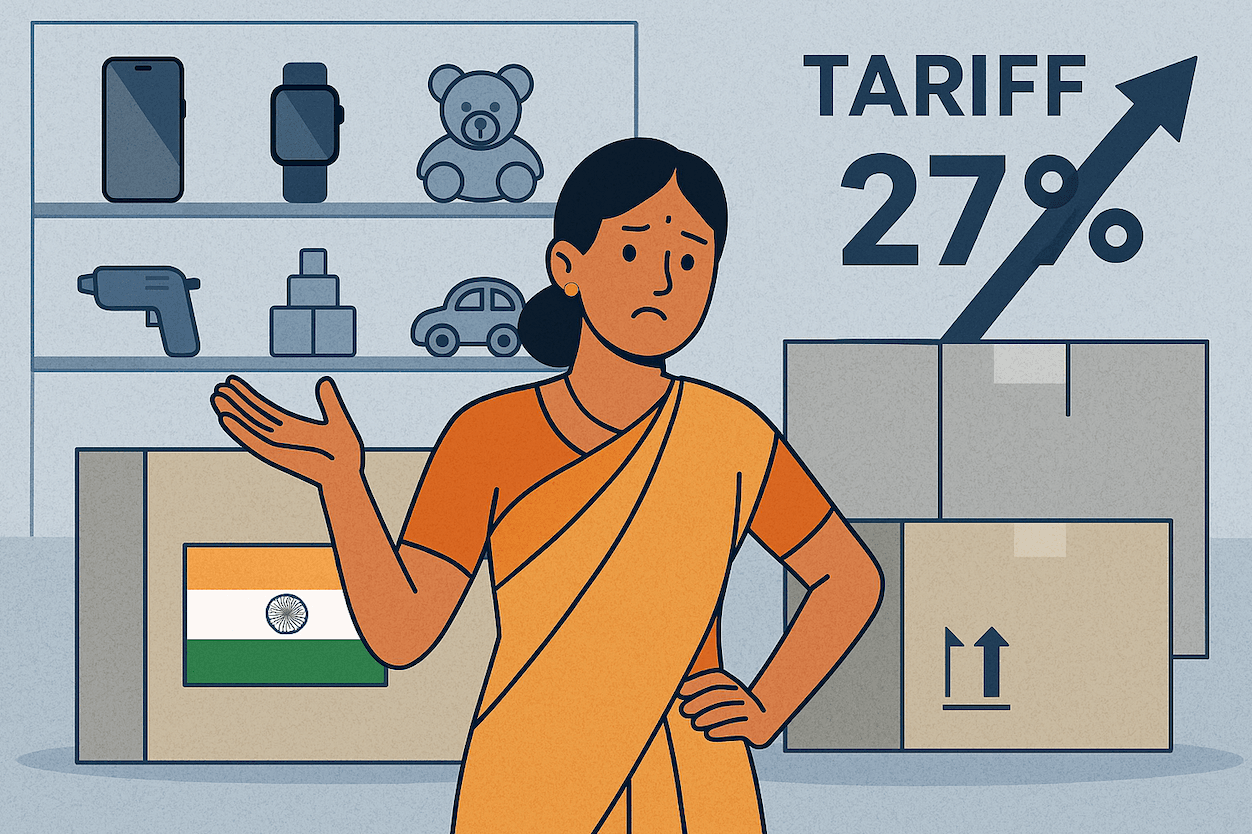

On April 9, 2025, the U.S. government, under President Donald Trump, imposed a 27% tariff on Indian goods entering the United States. This sweeping decision is part of a new protectionist trade strategy targeting major exporters like:

- China – 54%

- Vietnam – 46%

- Bangladesh – 37%

- Thailand – 36%

- India – 27%

This tariff has sent shockwaves through India’s cross-border e-commerce ecosystem, especially for small businesses and D2C brands reliant on U.S. customers.

⚡ What Does a 27% Tariff Mean for Indian E-Commerce?

If you're an Amazon India seller, a Shopify brand, or an Etsy artisan exporter, the implications are serious:

- Your products will become more expensive in the U.S.

- Your margins may shrink or disappear

- Your conversion rates may drop due to higher prices

For example, a ₹2,000 ($24) product could now cost over $30+ in the U.S. after duties and shipping, reducing your competitiveness.

🛍️ Industries Most Affected by the U.S. Tariff

Several sectors are particularly vulnerable to this change:

- 👗 Fashion & Jewelry

- 📱 Consumer Electronics (chargers, wearables, audio gear)

- 🧸 Toys & Games

- 🚗 Auto Components

- ⚙️ Engineering Goods

- 🐟 Marine & Seafood Exports

These categories often have thin margins and high shipping costs, making tariff hikes especially painful.

📉 Key Challenges for Indian E-Commerce Exporters

- Price Sensitivity: U.S. customers may opt for cheaper alternatives from tariff-free countries.

- Fulfillment Complexity: Cross-border logistics becomes more expensive and slower.

- Customs Compliance: More documentation and possible delays at U.S. ports.

- Cash Flow Issues: Inventory movement slows, affecting revenue cycles.

🚀 How Indian Sellers Can Respond to the Tariff Shock

While the situation is serious, it's not without opportunity — especially if India moves fast to fill gaps left by tariff-hit countries like China and Vietnam.

✅ 1. Diversify Export Markets

Don’t rely solely on the U.S. Explore emerging e-commerce hubs:

- 🌍 Middle East (UAE, Saudi Arabia via Amazon.ae or Noon)

- 🇪🇺 Europe (Germany, France, Netherlands)

- 🇸🇬 Southeast Asia (Singapore, Malaysia)

✅ 2. Re-Optimize Product & Fulfillment Strategy

- Offer lighter variants of products to cut shipping weight.

- Use bundles or value packs to improve perceived value.

- Consider U.S.-based warehousing like Amazon FBA to reduce landed costs.

✅ 3. Double Down on Brand Building

Compete on value, not price. Focus on:

- Brand storytelling: Emphasize your origin, mission, or craftsmanship.

- Niche positioning: Target communities looking for Indian, handmade, or ethical products.

- Premium presentation: Invest in better visuals, packaging, and trust signals.

✅ 4. Leverage Platforms and Tools

- Amazon SellerFlex for smoother fulfillment

- Shopify Markets to localize pricing and currencies

- Etsy Global Shipping for simplified logistics

- Helium 10 / Jungle Scout for competitive insights

- Payoneer / Wise for better international payouts

✅ 5. Collaborate on Policy & Infrastructure

Get involved in industry-led advocacy to push for:

- Tariff rebates or trade deals

- Infrastructure improvements at ports

- Customs and documentation reforms

- Better access to export financing for MSMEs

🌍 India’s Strategic Opportunity — If We Act Fast

While tariffs present a short-term threat, they also open a once-in-a-decade opportunity.

Countries like China and Bangladesh face even higher tariffs. If India can:

- Invest in manufacturing

- Simplify export compliance

- Upgrade logistics infrastructure

…it can fill the vacuum and become a preferred sourcing hub for global buyers seeking China alternatives.

📌 Final Thoughts

The new U.S. tariff on Indian exports isn’t just a trade policy — it’s a wake-up call for Indian e-commerce.

For sellers on Amazon, Shopify, Etsy, and beyond, the next 6–12 months are critical. You can either:

- Pivot and build a resilient cross-border model

- Or fall behind in a rapidly shifting global trade environment

The decision is yours.